Deep Dive Into Crypto Biggest News

Hey folks, welcome back! ☺️

Breaking: American retirement savers can now add alternative assets into their investment plans as President Trump signs the executive order opening the gates to riskier assets like crypto and private equity. Meanwhile, Harvard University, renowned for its academic prowess and global influence, has finally paved the path into crypto with $116 million investment in BlackRock’s Bitcoin ETF.

Headlines:

Trump Democratizes Access to Crypto for the U.S. Retirees

Harvard Invests $116 Million in BlackRock Bitcoin ETF

SEC Unveils Project Crypto

It's Officially Over for Ripple

Samourai Wallet Founders to Plead Guilty

Get the latest updates. Subscribe to WhaleTales today.

Deep Dive

🪙 Trump Democratizes Access to Crypto for the U.S. Retirees

U.S. President Donald Trump signed an executive order on Thursday that opens doors to alternative assets like cryptocurrencies, real estate, and private equity investments in 401(K) retirement plans.

In-depth

In a major move by the Trump administration, U.S. retirement savers can now invest their savings from defined contribution plans, including 401(K), into alternative assets like crypto. This paves the way for the asset industry and fund managers to access a $12.2 trillion market of retirement funds.

What’s new in the 401(K)? 🤔

President Trump directed the U.S. Secretary of Labor to review the fiduciary guidance and laws for alternative assets investments under 401(K) within 180 days. The American citizen retirement plans, including defined contribution plans, are governed by the Employee Retirement Income Security Act of 1974, or ERISA.

According to the new guidelines, retirees can limit investments to traditional stocks and bonds and redirect them to alternative assets like private funds and crypto.

How fruitful is it for investors? 🍏

The executive order is a big win for the alternative assets industry, but it brings new risks for American retirees.

The alternative assets industry is known for volatility, high fees, and a lack of transparency. According to Simon Tang, Director and Head of U.S. at Accelex, the “Private markets are a different ballgame. There's no real-time information, no ticker and no standardization, just fragmented documents and unstructured formats.”

Alternative assets in 401(K) rolls out Trump’s broader vision of expanding digital currencies into the mainstream, including retirement accounts. However, analysts are not so optimistic about crypto being included in the 401(K) because of its inherent speculative nature, enhanced risk, fraud, and high volatility.

🤝 In Partnership With The Pacaso / Pacaso

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Exclusive

🎓 Harvard Invests $116 Million in BlackRock Bitcoin ETF

Harvard, the prestigious Ivy League American university, recently came into the news for investing $116 million in BlackRock’s Bitcoin ETF (exchange-traded fund).

Details:

Harvard Management Company oversees the $53 billion (as of June 30, 2024) endowment fund and has made the hefty investment in BlackRock’s BTC ETF. According to the June 30 U.S. Securities and Exchange Commission (SEC) filing report, Harvard currently holds $1.9 million shares of the iShares Bitcoin ETF worth $116 million, which makes it the 5th largest Bitcoin holding after Microsoft, Amazon, and Meta.

This is a symbolic step for Harvard and marks its venture into the arena of digital asset investments. It also highlights the growing demand and mainstream adoption of Bitcoin and its role as a long-term strategic asset.

🎯 Together With INBO

A Dedicated Home for Your Favorite Newsletters

Your favorite newsletters arrive mixed with work emails, promotions, and notifications. By the time you have a moment to read, they're buried 50 emails deep.

INBO solves this with intentional design.

A calm, dedicated inbox where newsletters wait patiently for your attention, not competing with urgent messages or promotional noise.

Your reading time deserves better than email chaos.

📌 At A Glance

SEC Unveils Project Crypto 📢

On July 31, the SEC Chairman, Paul Atkins, launched the “Project Crypto,” an initiative to establish a clear regulatory framework for crypto assets in the U.S. and position America’s leadership in the global crypto assets market. In his speech, Atkins defined how the new project will aid President Trump in his historic efforts to make America the “crypto capital of the world.” He also outlined that the modernized securities regulations will enable American markets to integrate blockchain technology and move on-chain. SEC will work closely with the Crypto Task Force to roll out the project.📎Read More At CoinDCX.

It's Officially Over for Ripple ✅

In a landmark event, Ripple Labs and the SEC officially ended their years-long legal battle on August 7, 2025. In the final filing, Ripple and the SEC have jointly dismissed their appeals, and both parties have agreed to bear their own attorney fees and legal expenses. According to the 2023 ruling imposed by the U.S. District Judge Analisa Torres, Ripple will pay the $125 million fine, and the injunction against XRP sale to institutional investors remains intact. However, programmatic or retail XRP sales will not be considered securities and are finally out of the SEC regulations. This is a major turning point for XRP investors. Following the news, the XRP price has surged over 12% showing renewed optimism among investors.📎 Read More At Reuters.

Samourai Wallet Founders to Plead Guilty 🚨

Samourai Wallet co-founders Keonne Rodriguez and William Lonergan Hill will plead guilty to charges of a crypto mixing scheme. Earlier in April 2024, the co-founders denied involvement in the unlawful transaction of $2 billion and crypto mixing scam, and involvement in dark web marketplaces like Silk Road. The duo now faces a conspiracy charge, a maximum prison time of 20 years for money laundering conspiracy, and 5 years for unlicensed business operation. The trial will begin on November 3, 2025. 📎 Read More At Mitrade.com.

💡Good To Know

What is Tether Gold (XAUt)?

Tether Gold (XAUt) is a digital coin pegged to physical gold. Each XAUt or tether gold token represents true ownership of 1 troy ounce of gold, which is stored in a safe vault. XAUt tokens can be seamlessly transferred cross-border or can be fractionalized, democratizing access to token holders.

👉 Read More About Tether Gold At The Big Whale.

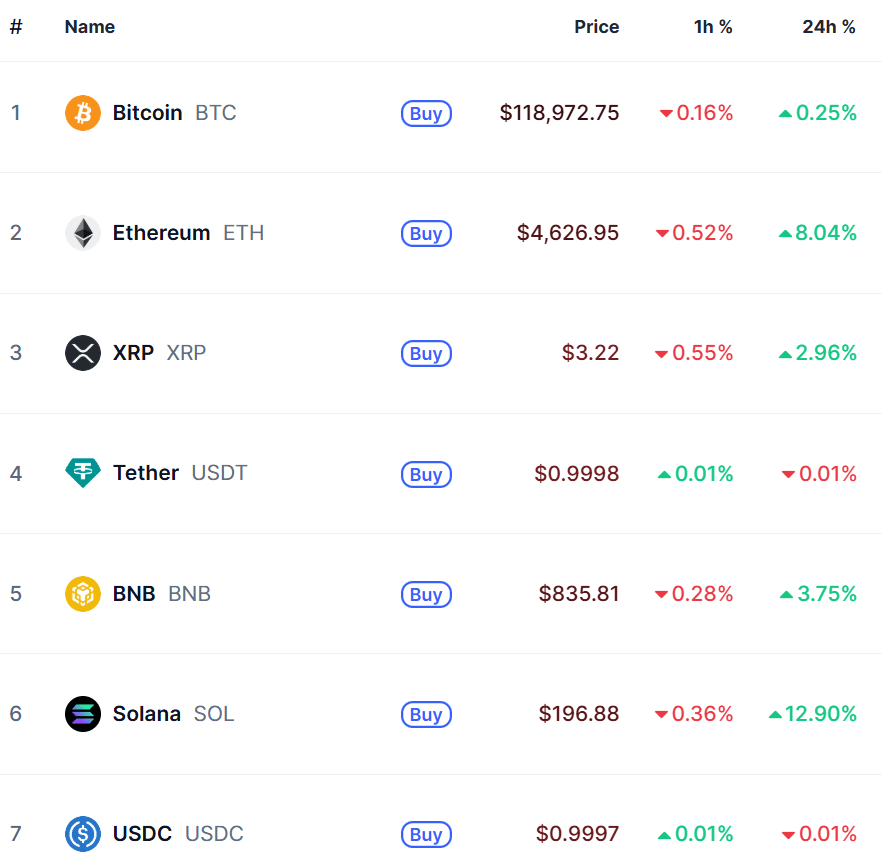

🌐 Market Map

Cryptocurrency prices on 6th August according to CoinMarketCap.

🍿 Quick Bytes

Trump crypto firm plans launch of public company that will hold family token. Fortune

Michael Saylor's Strategy buys another 155 BTC for $18 million to near 3% of bitcoin's total supply. The Block

BNC Invests $160 Million in BNB, Becomes Largest Corporate Holder of BNB Globally. Bitcoin.com

SEC declares liquid staking is outside of securities laws in latest guidance following ‘Project Crypto’ initiative. The Block

🤡 This Week’s Meme Drop

That’s it for this week guys. Before you go, do not forget to sign up with WhaleTales newsletter. See ya all next week. 🗞️😇

How did we do? Share your thoughts. 👇

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice.