Deep Dive Into Crypto Biggest News

GM, Readers! 🌞

Breaking: Over hundreds of crypto firms are under the radar of the SEC and FINRA for abnormal trading patterns. Find out why 👇

Spotlight: The British Sterling enters the tokenization revolution. Is it the future?

Headlines:

U.S. Regulators Probe 200+ Firms

Sterling Tokenization is Live

Tether Unleashes USA₮ Stablecoin

$44 Million Whale Wallet Awakens

Coinbase to Build Crypto Super App

Be the first to know the latest updates in crypto. Join for free. 📩

Deep Dive

🚨 SEC & FINRA Probe 200+ Firms Over Treasury Deals

📊 News flash: More than 200 firms under the SEC and FINRA scanner…Why?

The U.S. regulators, the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA), are investigating 200 firms that have announced crypto treasury plans for unusual stock trading patterns.

What Went Wrong? 🧐

According to a September 25 Wall Street Journal report, the SEC and FINRA, which oversee and enforce compliance with federal securities laws, have jointly announced a probe after citing unusual trading volumes and a sudden jump in stock prices in more than 200 crypto companies.

It all goes back to 2020, when MicroStrategy (now Strategy Inc.) CEO Michael Saylor decided to hold a crypto treasury for Bitcoin to hedge against inflation. Strategy became a trendsetter for treasury reserve assets, and other companies followed.

The Aftermath? 🔎

Such announcements of a treasury reserve create media hype and positive investor sentiment, drive demand, and spike the stock prices.

SEC & FINRA Insights 🕵️♂️

The SEC and FINRA smelled “unusual trading activity,” and stock prices in 200+ companies have spiked abnormally. Reports suggest that the stock prices have spiked even before the public announcement of treasury deals. Regulators suspect “insider trading” where company insiders have leaked non-public information to a cluster of handpicked investors.

What This Means: These red flag companies shared confidential information with selected investors ready to join their deal and sign a nondisclosure agreement. However, most of these agreements are not leak-proof. As the news spread, companies noticed an unusual spike in stock prices and trading patterns. This triggered the regulators.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Exclusive

🤝 UK Finance & Six Major Banks Launch Tokenized Sterling

🔔 Crypto Buzz: The traditional British pound gets a digital makeover with tokenized sterling deposits (GBTD). ✨

British Trade Association UK Finance launched the pilot phase of the digital representation of the British pound, sterling, on Friday, September 26.

What To Expect? 👀

In collaboration with six major banks, Barclays, HSBC, Lloyds Banking Group, NatWest, Nationwide, and Santander, UK Finance has started the pilot phase of tokenized sterling deposits that will run until mid-2026. Quant Network will provide the infrastructure for the GBTD project.

“This project is a powerful example of industry collaboration to deliver next-generation payments for the benefit of customers and businesses – and an opportunity for the UK to lead globally in setting standards for tokenised money,” said Jana Mackintosh, Managing Director at UK Finance.

The project will test on 3 core areas, namely, Peer-to-peer (direct buyer and seller) payments, remortgaging processes, and digital asset settlements.

The tokenized sterling project is an extension of the U.K.’s Regulated Liability Network (RLN) and the Bank of England’s initiative for digital money and a decentralized future.

What This Means: The tokenization of traditional currency like sterling in collaboration with England’s top banks highlights the UK’s broader adoption of next-gen payment models. It will bridge the gap between traditional and digital finance. Furthermore, tokenized deposits and payments are safer, automated, give control to token holders, and are backed by regulated banks.

📌 At A Glance

Tether Unleashes USA₮ Stablecoin 🚀

Tether, the world leader in stablecoin, has launched USA₮, the U.S.-compliant and dollar-pegged stablecoin, exclusively for the American market. Former White House Executive Director, Bo Hines, was appointed as the CEO of Tether’s USA₮. The newly-found stablecoin will be available by the end of the year. 📎 Read More at Tether.

$44 Million BTC Wallet Finally Awakens 🐳

A sleeping bitcoin whale wallet worth $44 million finally moves after 12 years on Sunday. According to data from Arkham Intelligence, the wallet with the address of “1ArUGfCLfuopJpmvXJoE5aKfYFLpxzwaWT” emptied all its funds and transferred nearly 400 BTC to multiple wallets. This is one of the many instances where Satoshi-era wallets have been active, breaking their dormancy in the last few months. 📎 Read More at The Block.

Coinbase To Build a Crypto Super App 📲

Coinbase CEO Brian Armstrong unveils plans to build an all-in-one crypto super app that offers crypto-backed credit cards, seamless payments, and Bitcoin rewards. Armstrong emphasised how users pay a hefty 2-3% transaction fee on every credit card swipe. He believes the recent pro-crypto moves and the latest SEC guidelines have been a game-changer for companies like Coinbase. He envisions building a future-ready app to replace traditional banks and streamline frictionless payments. 📎 Read More at Cointelegraph.

200+ AI Side Hustles to Start Right Now

From prompt engineering to AI apps, there are countless ways to profit from AI now. Our guide reveals 200+ actionable AI business models, from no-code solutions to advanced applications. Learn how people are earning $500-$10,000 monthly with tools that didn't exist last year. Sign up for The Hustle to get the guide and daily insights.

💡 Good To Know

Nearly 20% of Bitcoin is permanently lost due to forgotten passwords. Is it true?

Yes, it is widely believed that almost 4,000,000 Bitcoins, worth 20% of the total supply, are lost permanently. Here, “lost” does not mean the coins have disappeared into thin air; instead, they become irrecoverable.

All bitcoin wallets are protected by “private keys” or passwords. Generally, if you lose the password of your email account, there is an option to reset your password. In Bitcoin wallets, once you lose your password, it is impossible to access coins or even verify your account. Tip: Always Keep your passwords safe. 🔒

🎲 This Week’s Quiz:

What is the first block recorded on the blockchain called?

Last week’s quiz result: 21 million. Did you get it right? 🎊

We will declare the correct answer in the next edition. Until then, keep reading. 📰 ☕

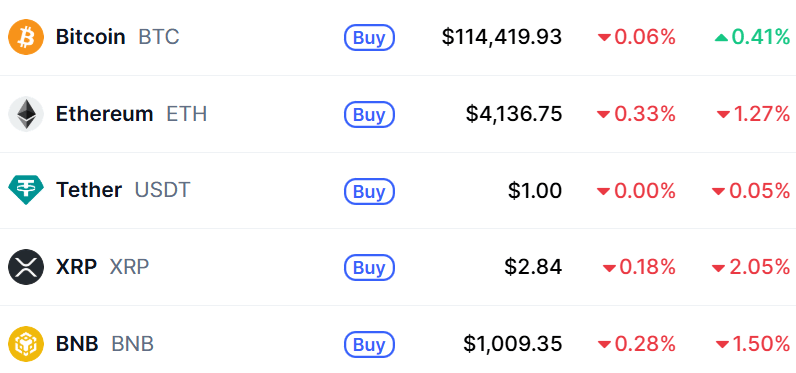

🌐 Market Map

The top five Cryptos according to CoinMarketCap, October 1, 2025.

🍿 Quick Bytes

XRP Declared the Official Currency of the European Union. Binance Square

Solana ETF Approvals Could Arrive by Mid-October, Says Analyst. Yahoo Finance

Texas brothers charged after allegedly holding Minnesota family hostage, stealing $8M in crypto. NBC News

Swift to Build a Blockchain-Based Ledger for Financial Firms. Bloomberg

🤡 This Week’s Meme Drop

That’s it, folks. Before you go, do not forget to sign up with the WhaleTales newsletter. See ya all next week. 🗞️😇

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice.