Deep Dive Into Crypto Biggest News

Frosty Morning, Folks! ❄️

December just landed, and here are the biggest stories in crypto this week.

Headlines:

Ethereum’s Fusaka Upgrade launches today.

UK Budget tightens crypto rules.

Coinbase C-suite sued for billions.

Lazarus Group Robs Again?

Sony Bank’s Stablecoin Push

Bitget’s AI-Trading Avatars

Deep Dive

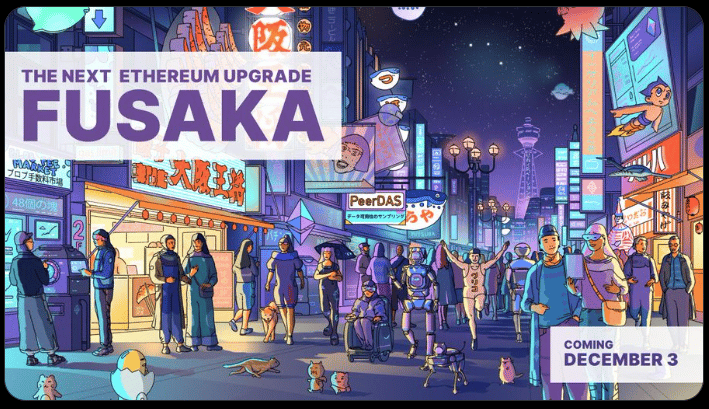

🔥Why are All Eyes on Ethereum’s FUSAKA Upgrade Today?

Source: @ethereum (X)

📊 News flash: December 3 marks one of the biggest days for blockchain evolution as Ethereum activates the much-awaited Fusaka Upgrade on its mainnet at 21:49:11 UTC at slot 13,164,544.

What is the FUSAKA Upgrade & why does it matter? 🤔

Will Ethereum’s FUSAKA Upgrade be the biggest game-changer in 2025-2026? Ethereum co-founder Vitalik Buterin believes that the upgrade will propel Ethereum’s mainstream adoption and radically improve its scalability.

Let’s break down what Fusaka really means:

Fusaka is an amalgamation of Ethereum’s Execution layer, “Osaka,” and its Consensus Layer, the Fulu. It is the biggest upgrade after Ethereum’s Pectra, executed on May 7, 2025.

What the upgrade offers:

PeerDAS (Peer Data Availability Sampling): Fusaka’s HERO feature that allows faster and easier data verification by sampling small segments of blob data instead of downloading the entire thing, theoretically scaling up data capacity by 8 times. The upgrade improves Layer-2 (L2) efficiency and reduces transaction costs.

📝Note: For those new to the term “blobs,” here is a quick explanation: Blobs represent large, temporary data segments that can be added to Ethereum blocks. These blobs are only stored for 18 days and do not occupy permanent storage spaces. Data blobs can process large volumes of data and are extremely beneficial for Ethereum’s L2 solutions.

Boost Layer-1 gas limit: Currently, the mainnet transaction gas limit is at 45M. Fusaka’s EIP-7935 can significantly raise it to 60 million gas units. Meaning? Faster transactions, lesser network congestion, and a significant drop in transaction fees.

Native secp256r1 UX upgrade: A built-in secp256r1 UX support that allows users to verify transactions with Apple FaceID and TouchID, eliminating one of the biggest roadblocks to mainstream adoption.

Matt Hougan, CIO at BitwiseInvest, wrote on X, “I suspect the market will start to orient around the positive impacts of Fusaka soon, particularly if its delivered Dec. 3 as expected. It’s an under-appreciated catalyst and one reason ETH could lead the crypto rebound.”

The Fusaka Upgrade is a major development in the Ethereum ecosystem. Experts say that it can significantly improve L2’s scalability and speed. But it is still too early to say whether it will immediately bolster market interest or strengthen ETH’s long-term position.

🤝 In Partnership with RAD Intel

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Regulation Watch

📜 UK 2025 Budget Tightens Crypto Rules for Traders from Jan 1

🔔 Regulation Update: The UK government has announced in its 2025 budget to implement new rules for all UK crypto asset users and UK-registered crypto exchanges.

Details:

Beginning from January 1, 2026, it is now mandatory for all crypto exchanges operating in the UK to disclose complete transaction histories and customers’ personal details.

The Cryptoasset Reporting Framework (CARF), as part of the Organisation for Economic Development (OECD), states that all crypto exchanges and crypto asset service providers must report to the HM Revenue and Customs (HMRC) and provide complete customer information, including crypto transactions and tax numbers.

The UK Budget 2025, published on 26 November, says “Information for first reports to HMRC will be collected from 1 January 2026 and reported to HMRC in 2027.”

CARF intends to tighten crypto regulations and manage tax evasion. According to the new law, the UK government will double the penalty from April 1, 2026, for late submissions of Corporation Tax.

HMRC has also indicated that taxes will not be applied simply for depositing crypto in lending platforms. Tax will be due only when the crypto assets are sold or traded to realize profits and losses.

What This Means: CARF compliance will enhance transparency, trust, and greater institutional participation. It will identify undisclosed income and bring crypto service providers and traders in the UK under a common standard jurisdiction.

🎯 A Message From AltIndex

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Exclusive

😬 Coinbase C-Suite Sued for Billions Over Insider Trading Scam

The Inside Story:

A group of stockholders in Delaware has filed a lawsuit against Coinbase, accusing the company’s top executives and insiders of withholding years of information related to inadequate Know Your Customer (KYC) compliance and ongoing regulatory probes.

Plaintiffs alleged that Coinbase’s C-Suite leaders and insiders, including CEO Brian Armstrong and board member Marc Andreeson, have sold $4.2 billion by artificially inflating Coinbase stock prices. In 2023, a similar lawsuit was filed against Coinbase’s senior leadership in the Delaware Court.

The lawsuit was filed before Thanksgiving, as Coinbase planned to relocate from Delaware to Texas.

💡 Good To Know

What is Permissioned DeFi?

DeFi, or decentralized finance, at its core, is permissionless. Meaning? Anyone with an internet connection can access DeFi platforms, products, or services without the intervention of any centralized authority, like banks, or disclosing personal details.

Permissioned DeFi (PDeFi) is a bridge between the decentralized economy and traditional finance. They are compliance-ready and integrate regulatory frameworks while maintaining the decentralized nature of the ecosystem.

In other words, they are regulated DeFi that implement extra security layers to protect customers, smart contracts, DeFi payment systems, and liquidity pools. PDeFi enforces KYC (Know Your Customer) verification and is only open to whitelisted participants.

🎲 Play the Quiz

The main function of a smart contract is:

Last week’s quiz result: Option D: Both A & C.

📌 At A Glance

Infamous Lazarus Group Robs Again? 🚨

On November 27, leading South Korean crypto exchange Upbit discovered an unauthorized withdrawal of 44.5 million won ($30.4 million) on the Solana network. The Seoul-based crypto exchange strongly suspects that the North Korean hacker gang, the Lazarus Group, is behind the heist. This is the second time that Lazarus struck the exchange. The first was in November 2019, when Lazarus stole crypto assets worth 58 billion won ($49 million). South Korea’s National Intelligence Service is investigating the heist.

Sony Bank’s Stablecoin Push in the U.S. 💵

Sony Bank prepares to issue a U.S. dollar-pegged stablecoin by 2026. In October this year, Sony Bank submitted its application for a banking license in the U.S. The bank partnered with Bastion, a regulated U.S. stablecoin infrastructure solution provider, to expand its services in this sector. The new stablecoin will merge with Sony Group’s anime and gaming platforms. After the launch, consumers can easily pay for subscriptions through stablecoin instead of costly credit cards.

Bitget Unveils AI-Powered Trading Avatars🤖

Bitget debuts seven AI-powered trading avatars on the GetAgent platform on November 24, accelerating smart trading experience for U.S. users. Each avatar has unique trading logic and executes trades in real-time. Users can select an avatar based on their trading needs. Additionally, Bitget announced a 10,000 Airdrop pool for users who complete a copy-trade and send a message to GetAgent. The first 100 successful copy traders can win 100 USDT worth of copy trading vouchers.

🌐 Market Map

Based on CoinMarketCap Data, Dec 3, 1:22 AM ET.

🤡 This Week’s Meme Drop

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice.

All opinions expressed on this website and/or email do not necessarily reflect the opinions of WhaleTales or its affiliates. You should not treat any opinion expressed in published materials as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of the editor’s opinion.

WhaleTales, and its subsidiaries, is a publishing company and the indicators, strategies, reports, articles and all other features of its products are provided for informational and educational purposes only and should not be construed as personalized investment advice. Our recommendations and analysis are based on SEC filings, current events, interviews, corporate press releases and news aggregation. Our materials may contain errors and you shouldn’t make any investment decision based solely on this or any editorial.

Readers should be aware that trading stocks and all other financial instruments including digital assets like crypto currencies involves risk. Past performance is no guarantee of future results, and we make no representation that any reader or customer will or is likely to achieve similar results. For personalized investment advice consult with a registered investment advisor.