Deep Dive Into Crypto Biggest News

Hey folks, welcome back! 😊

Breaking News: Trump’s GENIUS Act makes history, becoming the first major U.S. law to offer the long-awaited regulatory clarity to stablecoins, receiving a rare bipartisan vote, and limits SEC intervention.

Meanwhile, crypto enthusiasts are anticipating whether the reign of Bitcoin Dominance is finally fading as altcoin season begins to rally. Let’s wait and watch.

Headlines:

Trump Signs GENIUS Act Into U.S. Law

Is the Altcoin Season Finally Here?

India’s CoinDCX Offers $11M Bounty $44M Hack

JPMorgan Considers Crypto-Backed Loans

Strategy Adds $739.8 Million to BTC Holdings

To get the latest updates, subscribe to WhaleTales today.

Deep Dive

✍️ Trump Signs GENIUS Act Into U.S. Law

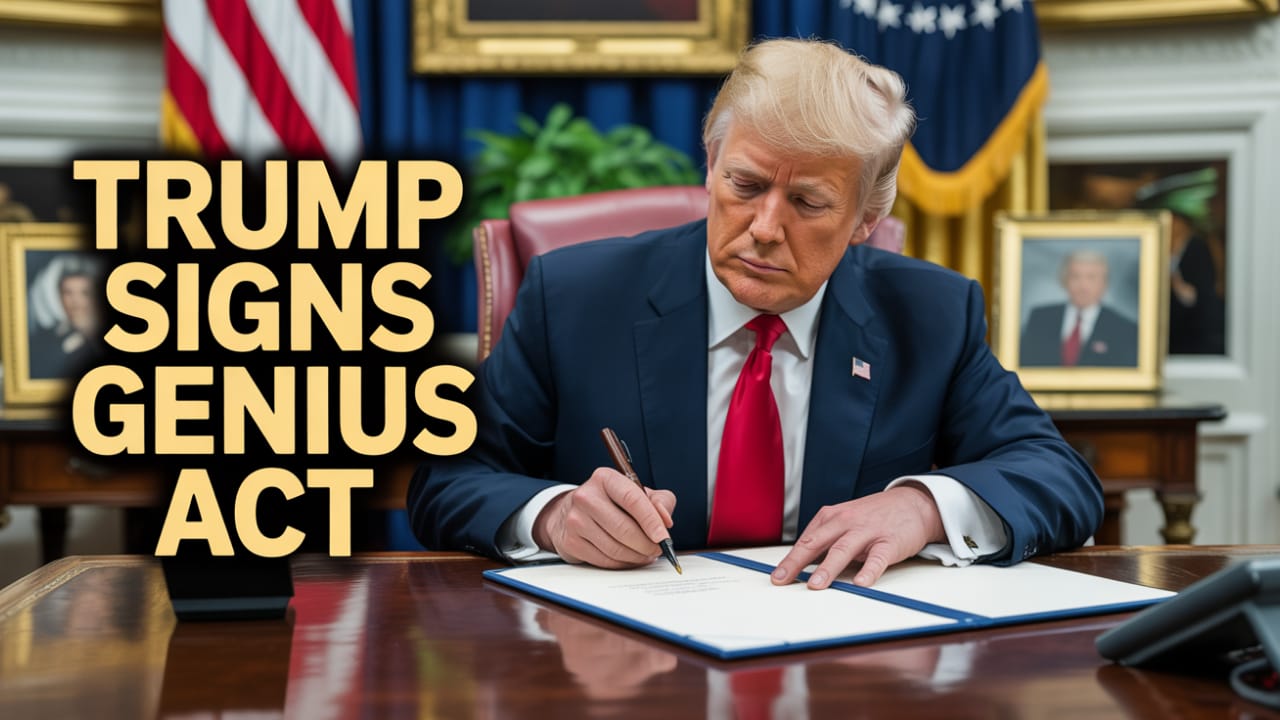

President Donald Trump delivering a speech during the signing ceremony of the “GENIUS Act” at the Whitehouse, July 18, Friday. (Source: Fox News)

It’s official: In a historic event, President Donald Trump signed the GENIUS Act into law on Friday, July 18, in the presence of industry leaders and top executives at the White House in Washington.

In-depth:

Industry tycoons like Kraken co-CEO David Ripley, Coinbase CEO Brian Armstrong, Robinhood CEO Vladimir Tenev, Circle CEO Jeremy Allaire, and many more witnessed the high-profile event.

During his speech at the White House on July 18, President Trump said, “Just as I promised last year, the GENIUS Act creates a clear and simple regulatory framework to establish and unleash the immense promise of dollar-backed stablecoin.” He added, “This could be perhaps the greatest revolution in financial technology since the birth of the internet itself.”

The Genius Act's official signing was a major political event that established a legal foundation for the U.S. dollar-backed stablecoins.

What is Trump’s GENIUS Act?

The “Guiding and Establishing National Innovation for U.S. Stablecoins” Act, abbreviated as the GENIUS Act, establishes regulatory clarity, guidelines, and consumer protections for U.S. dollar-backed stablecoins.

The law sets some clear boundaries:

Implements 1:1 backing. All stablecoins must be fully pegged to U.S. dollars or 3-month U.S. Treasury bills (T-bills). Digital or risky assets like crypto are not allowed.

Stablecoin issuers and companies must disclose their monthly reserves, even for industry big players.

Strict Anti-Money Laundering (AML) rules will be administered.

Consumers get legal protection and first rights to reserves if an issuer goes bankrupt.

The GENIUS Act carves out the long-awaited regulatory clarity for stablecoin issuers and establishes itself as the “Payment Stablecoins,” removing the SEC’s (Securities and Exchange Commission) jurisdiction.

👉 Also Read: What the GENIUS Act Means for XRP Investors.

🤝 In Partnership With The Pacaso / Pacaso

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Exclusive

🚀 Is the Altcoin Season Finally Here?

Despite its initial spike to $123K, Bitcoin Dominance has slipped to $117K on early Tuesday, suggesting that the Altcoin Season must be arriving.

Details:

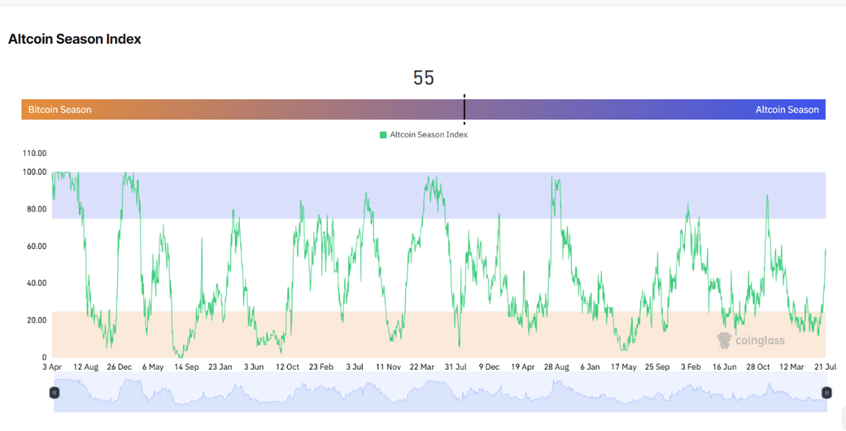

The past few months have been a one-man show, with Bitcoin Dominance rising as high as 66% and altcoins taking a backstage. However, July seems favourable for altcoins, marking a comeback with Ethereum dominance surging to 24% and Bitcoin Dominance dropping below 63%. According to Coinglass’s Altcoin Season Index, the chart indicates that altcoins are at 55 and moving upwards, highlighting that we are edging towards an altcoin season. Historically, when an index climbs towards 75, it suggests an altcoin rally.

Source: CoinGlass

Is Ether back? 🤔

Ethereum, the undisputed king of altcoins, reclaims the market with ETH prices surging by over 25%, with new ETH inflows worth $2.12 billion last week. Earlier on Monday, ETH prices hit a fresh high of $3848, and with its stunning rally, analysts believe that ETH could break $4000 soon.

Following the surge, meme coins like Pepe, Fartcoin, and DOGE are showing bullish trends. Furthermore, the GENIUS Act may prove strong for Ethereum and other layer-1 solutions like SOL and XRP, bringing more institutional investments. To further fuel the Ethereum rally, Ether Machine announced on July 21 its public launch with over $1.5 billion in capital on Nasdaq.

👉 Read More: Ether Machine, backed by crypto giants, set to raise over $1.6 billion in Nasdaq debut.

🎯 Together With The Morning Brew

Business news as it should be.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

📌 At A Glance

India’s CoinDCX Offers $11M Bounty $44M Hack 👀

India’s leading crypto exchange, CoinDCX, confirmed a $44 million security hack after cybercriminals breached an internal operational account for liquidity provisions. CoinDCX co-founder and CEO, Sumit Gupta, disclosed on X that customer “assets remain completely safe and protected in our secure cold wallet infrastructure.” The incident highlights the second biggest crypto exchange hack in India after one year of the infamous WazirX breach worth $230 million in July 2024. Read Here: CoinCentral.

Wall Street giant JPMorgan Chase is reportedly considering offering loans secured by customers’ crypto holdings, including Bitcoin and Ethereum, amid the stablecoin rollout. The company plans to launch the innovative scheme early next year, marking a significant shift in the broader crypto adoption and digital asset-backed loans. Read Here: Decrypt.

Strategy Adds $739.8 Million to BTC Holdings 💰

In a major Bitcoin move, Michael Saylor’s Strategy (formerly MicroStrategy) spent a hefty $739.8 million to acquire 6,220 BTC, paying nearly $118,940 per bitcoin. With its latest big purchase, the world’s largest public Bitcoin holder now owns 607,770 BTC, further marking its dominance in Bitcoin acquisitions. Read Here: The Block.

💡Good To Know

What is Altcoin Season Index?

The Altcoin Season Index is a tracker that helps investors and crypto analysts evaluate the market performance of altcoins in comparison to Bitcoin. It is a crucial indicator to analyze whether altcoins will outperform Bitcoin by studying the market trends and insights. It predicts the arrival of the “altcoin season,” though it is impossible to give an exact prediction. It also shows the percentage of altcoin growth compared to Bitcoin over the past 90 days. It is a helpful tool for planning and adjusting investment strategies based on current market trends.

🌐 Market Map

Cryptocurrency prices on 23rd July according to CoinMarketCap.

🍿 Quick Bytes

‘Unleash The Next Wave’—$4 Trillion Crypto Braces For ‘Big’ Price Catalyst As Bitcoin, Ethereum And XRP Soar. Forbes

Pi Network Enables Direct Fiat Purchases With New “Buy” Feature. CoinGape

Trump Media buys $2 billion in Bitcoin for crypto treasury plan, US President’s stake in company now worth $2.3 billion. Financial Express

BitGo joins crypto IPO rush as sector hits $4 trillion in market value. Reuters

🤡 This Week’s Meme Drop

That’s it for this week guys. Before you go, do not forget to sign up with WhaleTales newsletter. See ya all next week. 🗞️😇

How did we do? Share your thoughts. 👇

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice.