GM, Readers!

While the crypto market edges towards a cautious recovery, Trump’s latest tariff threat aimed at eight European countries triggered a fresh shock. The aftermath? Around $875 million in crypto was liquidated. The broader market bore the brunt, and Bitcoin slid sharply below $92K on Monday.

Top stories this week:

Coinbase vs. White House → Rug Pull Drama.

NYSE Plans 24/7 Securities Trading Platform.

Other Headlines:

ETH Hits Transaction Record.

Forfeited Samourai BTC Not Sold.

Canaan Faces Nasdaq Warning.

DEEP DIVE

⚔️ Coinbase Vs. White House: A “Rug Pull” Drama Unfolds

Breaking: The biggest fallout ever! The White House has reportedly threatened to withdraw support for the Senate-backed crypto market structure bill (Digital Asset Market Clarity Act) after Coinbase pulled its backing at the eleventh hour.

What Happened

What was supposed to be one of the biggest regulatory victories hit a sudden setback.

Coinbase, the U.S.’s largest crypto exchange, decided to pull back support just a day before the January 15 Senate Banking Committee markup hearing.

“We’d rather have no bill than a bad bill. Hopefully we can all get to a better draft,” Brian Armstrong, CEO at Coinbase, said on X.

Armstrong publicly listed several issues with the Senate Banking draft, including a “de facto ban” on tokenized equities, restrictions on stablecoin reward allowance, privacy concerns, DeFi roadblocks, and expanded SEC intervention.

White House Strikes Back

According to Crypto to America journalist Eleanor Terret, the Trump administration was reportedly “furious” with the sudden backout. They called Coinbase’s “unilateral action” a “rug pull” against White House and the broader crypto industry.

“This is President Trump’s bill at the end of the day, not Brian Armstrong’s,” sources said.

According to reports, White House is considering withdrawing support after the dispute.

Armstrong Reacts

Following the public rift, Armstrong denied the reports that White House had completely withdrawn its support. He emphasized that the administration has been “super constructive” and there are ongoing talks about possible negotiations.

Delayed…Not Dead

Following the fallout, the Senate Banking Committee Chair Tim Scott officially postponed the markup hearing.

The crypto community and lawmakers shared mixed reviews. While many supported Coinbase’s stance, others feel that it might have derailed the much-needed regulatory clarity.

A glimmer of hope…

Despite the setback, U.S. Senator Cynthia Lummis is hopeful. She posted on X, “we are closer than ever. Everyone is still at the negotiating table.”

What happens next: Crypto advocates are hopeful that the Senate Banking and Agriculture Committees will reopen negotiation talks on Friday this week. The Senate Agriculture Committee hearing is still scheduled for January 27.

👉 Also Read: UK FCA Signals Licensing Gateway in September 2026: FCA Roadmap.

Together With Wispr Flow

Vibe code with your voice

Vibe code by voice. Wispr Flow lets you dictate prompts, PRDs, bug reproductions, and code review notes directly in Cursor, Warp, or your editor of choice. Speak instructions and Flow will auto-tag file names, preserve variable names and inline identifiers, and format lists and steps for immediate pasting into GitHub, Jira, or Docs. That means less retyping, fewer copy and paste errors, and faster triage. Use voice to dictate prompts and directions inside Cursor or Warp and get developer-ready text with file name recognition and variable recognition built in. For deeper context and examples, see our Vibe Coding article on wisprflow.ai. Try Wispr Flow for engineers.

UPDATE

⏰ NYSE Plans 24/7 Securities Trading Platform

The New York Stock Exchange (NYSE), a subsidiary of the Intercontinental Exchange (ICE), issued a press release on Monday about a new 24/7 tokenized securities trading platform. NYSE is currently seeking regulatory approvals.

What To Know

The new digital platform is part of ICE’s broader vision to bridge traditional finance and develop a seamless and secure platform for round-the-clock trading of tokenized assets.

The platform will integrate with TradFi banks BNY (NYSE: BK) and Citi (NYSE: C). These banks will support and manage tokenized deposits outside regular banking hours for different time zones and jurisdictions.

If approved, the platform will offer:

24/7 trading of U.S.-listed ETFs and equities.

Instant settlement via tokenized capital.

Fractional share trading via dollar-sized orders.

Stablecoin-based funding for easy trading.

Blockchain-based trading for multi-chain settlements.

“We are leading the industry toward fully on-chain solutions, grounded in the unmatched protections and high regulatory standards that position us to marry trust with state-of-the-art technology,” said NYSE Group President Lynn Martin.

NYSE’s new venture is a big step forward from its traditional 5-day-a-week schedule to 24/7 trading for both traditional stocks and digital tokens.

Together With Attio

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

EXCLUSIVE

🚀ETH Hits Record-High Transactions & Near-Zero Gas Fees

Ethereum is in full throttle. The network processed record-high daily transactions with an all-time high of nearly 2,885,524 transactions on January 16, and gas fees plummeted below 1 cent.

A Historic Surge

The historic surge was the result of Ethereum’s recent upgrades, such as Fusaka and Pectra upgrades, and layer-2 networks that absorbed massive volumes of transactions. While Ethereum’s daily transactions skyrocketed, its average gas fees sank below $0.01.

Staking Activities

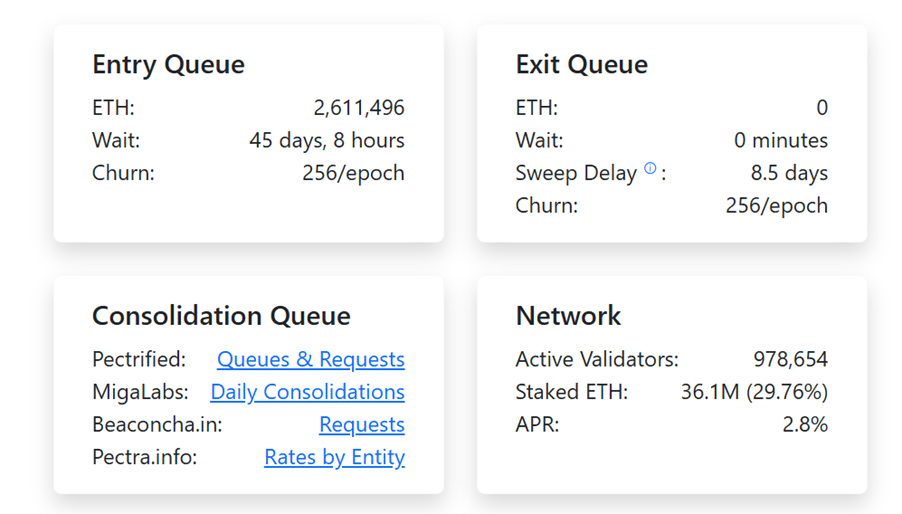

According to the Ethereum Validator Queue, its exit queue has dropped to zero, and the entry queue has reached 2,611,496.

This suggests almost zero selling pressure or rush to withdraw assets. Meanwhile, the network is also processing the exit backlogs efficiently, facilitating immediate withdrawal of staked ETH and exits in minutes. However, entry queues are still busy and long, showing active validator interests.

GOOD TO KNOW

SEC Releases Crypto FAQs

On December 17, 2025, the U.S. SEC published a comprehensive set of “Frequently Asked Questions” related to crypto asset activities and blockchain’s distributed ledger technology (DLT).

The document records “Staff” responses of the Division of Trading and Markets of the SEC. The Commission clarified that these responses are not rules and do not have any legal binding. These are simple guidelines from the “Staff.” The SEC has “neither approved nor disapproved” the content.

Read the SEC’s full FAQ guide: here.

🎲 PLAY THE QUIZ

Who is the original creator of the “smart contracts” concept?

Last week’s quiz result: Option 2.

Keep playing folks! 🎲

AT A GLANCE

🔒Forfeited Samourai Wallet BTC Were Not Sold

The White House confirmed on Friday that the $6.4 million of forfeited Samourai Wallet Bitcoins were not sold by the Department of Justice (DOJ) and will be added to the U.S. Strategic Bitcoin Reserve.

The Details

On January 16, 2026, Patrick Witt, Executive Director at the President’s Council of Advisors for Digital Assets, announced on X that the DOJ has confirmed that none of the forfeited Samourai Wallet bitcoins were liquidated, as per Executive Order (EO) 14233.

Note: The EO 14233 was signed by President Trump on March 6, 2025, to establish the Strategic Bitcoin Reserve and United States Digital Asset Stockpile. Under this order, all forfeited Bitcoins were to be held in the Bitcoin Reserve and may not be liquidated.

The Backdrop

In August 2025, Samourai Wallet creators Keonne Rodriguez and William Lonergan Hill pleaded guilty to conspiracy charges for unlicensed money transmitting businesses. DOJ alleged that the duo managed to execute illegal transactions worth over $200 million through crypto mixing services.

On November 3, 2025, Arkham Intelligence identified on-chain data suggesting that the United States Marshals Service (USMS), under the DOJ directive, sold nearly 57.55 Bitcoins worth of $6.3 million in Samourai Wallet Bitcoins through a Coinbase Prime deposit address.

The destination addresses later showed a zero balance, indicating that the forfeited BTC has been sold. This move directly violates Trump’s EO 14233 of unlawful liquidation of forfeited Bitcoin.

DOJ later clarified that the move of the forfeited Bitcoins to Coinbase Prime was for custodian purposes related to the Bitcoin Reserve, and there was no liquidation.

Now Read This 👇

⚠️Canaan Inc. Faces Nasdaq Delisting Warning

Singapore-based Bitcoin mining hardware manufacturer, Cannan Inc. (NASDAQ: CAN), has received a delisting threat from Nasdaq.

On January 16, Canaan issued a news release that it had received a written notice from Nasdaq Stock Market LLC of non-compliance with Nasdaq Listing Rule 5550(a)(2) as its shares traded below $1 per share for 30 consecutive days.

Canaan stated that Nasdaq has granted an extension of 180 days (till July 13), during which they must close over $1 for at least ten consecutive trading days to recover compliance.

🌐 MARKET MAP

Based on CoinMarketCap data, 21 January, 2026, 1:11 AM, ET.

😏 TODAY’S MEME DROP

That’s a wrap, folks! Stay tuned for trending news at WhaleTales. 🐳

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice.

All opinions expressed on this website and/or email do not necessarily reflect the opinions of WhaleTales or its affiliates. You should not treat any opinion expressed in published materials as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of the editor’s opinion.

WhaleTales, and its subsidiaries, is a publishing company and the indicators, strategies, reports, articles and all other features of its products are provided for informational and educational purposes only and should not be construed as personalized investment advice. Our recommendations and analysis are based on SEC filings, current events, interviews, corporate press releases and news aggregation. Our materials may contain errors and you shouldn’t make any investment decision based solely on this or any editorial.

Readers should be aware that trading stocks and all other financial instruments including digital assets like crypto currencies involves risk. Past performance is no guarantee of future results, and we make no representation that any reader or customer will or is likely to achieve similar results. For personalized investment advice consult with a registered investment advisor.