Hey Explorers!

Welcome back to WhaleTales, your weekly digest on crypto's hottest stories.

History repeats itself. On the iconic Bitcoin Pizza Day on May 22, Bitcoin surpassed a new all-time high of $110K. On more news, the U.S. Senate finally passed the Genius Act to regulate stablecoins. Kraken bridges TradeFi by launching xStocks for non-U.S. citizens. On a final note, yet another scalability push from Buterin with the proposal of the “partially stateless” model to reduce hardware load.

📬 In This Week’s Top News:

Bitcoin Beats Its Record - Smashes an All-Time High of $110K on Iconic Bitcoin Pizza Day!

Could the Genius Act Drive Greater Stablecoin Regulation in the U.S.?

Kraken to Launch xStocks on Solana Blockchain – Brings U.S. Equities On-chain.

Vitalik Buterin Proposes Partially Stateless to Reduce Hardware Burden

Thanks for reading WhaleTales! Subscribe to get the latest buzz in the crypto frontier.

The Big Story

🚀 Bitcoin Beats Its Record – Smashes an All-Time High of $110K on Iconic Bitcoin Pizza Day! 🍕

On this day 15 years ago, a Florida programmer named Laszlo Hanyecz spent 10,000 BTC to purchase two slices of pizza! Since that day, May 22 has become iconic. It symbolized the first-ever Bitcoin transaction and its real-world valuation in history.

Today, May 22, 2025, on the 15th anniversary of Bitcoin Pizza Day, history has repeated itself. Bitcoin beats its own record and surpasses a new all-time high (ATH) of $111,608.61, making another milestone, indicating a bullish sentiment. and raising the question: Is it the beginning of the next bull run?

Source: X

👉 Also Read: What is Bitcoin Pizza Day?

Bitcoin's rally towards new records has been triggered by the U.S. crypto regulation, which has developed a growing optimism among institutional buyers.

James Butterfill, Head of Research at CoinShares, told CNBC in an email:

“Driven by a mix of positive momentum, growing optimism around U.S. crypto regulation, and continued interest from institutional buyers.”

The flagship cryptocurrency has now been crowned the 5th largest global asset with a market capitalization of $2.158 trillion, surpassing global stalwarts like Amazon (AMZN) and Google, which stand at $2.152 and $2.096 trillion, respectively.

Source: Kitco.com

Amid the price upswing, Bitcoin Futures have gained significantly, with the highest sale value of $74 billion indicating a bullish sentiment among traders and renewed optimism on crypto investments, according to CoinGlass data.

What led to the surge?

Besides the U.S. crypto regulatory movement, the DeFi market is witnessing a significant shift with more retail investors re-entering the market with smaller investment thresholds. This indicates a broader confidence among crypto investors and the entry of fresh liquidity into the market.

Bitcoin prices seem to have stabilized and are up by 18% this year. Earlier in May, the U.S. Senate had decided to advance the Genius Act, a stablecoin bill, which might have also influenced the BTC prices.

👉 Must Read: What the Genius Act Means for Crypto Investments?

While several factors have shaped Bitcoin’s performance throughout the past months, Thursday, May 22, 2025, will always be a landmark moment. On this day, BTC has yet again repeated history and reached a record-breaking all-time high.

In Partnership with Superhuman AI

A Few Words From Our Partner

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

In the Spotlight

📜 Could the Genius Act Drive Greater Stablecoin Regulation in the U.S.? 📈

The U.S. Senate has successfully crossed the first hurdle for the crypto regulatory framework, the Genius Act, with a 66-32 vote.

The stablecoin industry is rapidly evolving with a market cap of $245, and the new legislation is a step forward in offering regulatory clarity to consumers and advocating dollar-backed crypto investments.

Stablecoin advocate and tech founder, David Sacks, said:

“If we provide the legal clarity and legal framework for this, I think we could create trillions of dollars of demand for our Treasuries practically overnight.”

Source: X

What is Genius Act for stablecoins?

Unlike other crypto assets, the value of a stablecoin is pegged to a fiat currency like the U.S. dollar or real-world assets like gold. As the name suggests, it mitigates risks and offers more stability to crypto transactions.

Tether (USDT), one of the most popular stablecoins, is ruling the market with a market cap of nearly $152 billion and outpacing PayPal and Visa in weekly transactions. However, the market was largely unregulated.

According to the Genius Act bill, all stablecoins will be backed by liquid reserves and U.S. Treasury bonds. It also highlights the industry’s shift towards a standardized regulatory framework.

The Genius Act will further establish clear guidelines, rules, and transparency and ensure accountability from firms in crypto issuance and other operations. It will overcome the long-term legal uncertainty, offer greater clarity to investors, define standards for digital assets, and foster global recognition of digital asset investments.

It seems like not everyone is pleased with the regulation

The stablecoin legislation has received a fair amount of backlash on ethical and political grounds. Lawmakers and democrats have earlier rejected the crypto regulation on account of President Trump’s extended personal crypto venture. They had concerns that, though the bill might establish clearer and standardized guidelines for stablecoins, it may be a part of Trump’s family business and may endanger national security and create unnecessary conflicts of interest.

👉 Must Read: Trump’s crypto agenda threatens the new legislation?

The U.S. Senator Elizabeth Warren emphasized the implementation of stronger ethics and regulations to ensure the bill is not compromised, and that an elected official or individual in power should not profit from it.

Warren said:

“This isn’t just about stablecoins; it’s about the integrity of our institutions.” “Without clear guardrails, we’re opening the door to corruption on a historic scale.”

Stablecoins pave the way to the rise of a new asset class that is government-compliant and offers economic security.

Sponsored by The Pacaso/Pacaso

A Few Words From Our Sponsor

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors couldn’t join until then, missing early gains. So he did things differently with Pacaso. They’ve made $110M+ in gross profits disrupting a $1.3T market. And after reserving the Nasdaq ticker PCSO, you can join for $2.80/share until 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Also Read

🦑 Kraken to Launch xStocks on Solana Blockchain – Brings U.S. Equities On-chain

Kraken crypto exchange announced the launch of a new xStocks, tokenized U.S. equities, in partnership with Backed through the Solana Foundation network, that will be available to investors outside the U.S.

The exchange, along with Backed, a firm specializing in decentralized financial assets, will launch xStocks, consisting of 55 U.S. popular stocks like Tesla, Apple, SPDR, Nvidia, and ETFs as tokenized assets (tokens) on the Solana Blockchain and will soon be available on the Kraken application. The product will be available 24/7 on their platform to non-U.S. users like Asia, Latin America, and Africa.

Kraken Global Head for Consumer, Mark Greenberg, said:

“Access to traditional U.S. equities remains slow, costly and restricted. With xStocks, we’re using blockchain technology to deliver something better – open, instant, accessible and borderless exposure to some of America’s most iconic companies. This is what the future of investing looks like.”

With xStocks, Kraken envisions democratizing global access to the U.S.–listed stocks and equities and fostering borderless, 24/7, and permissionless investment opportunities to a global audience.

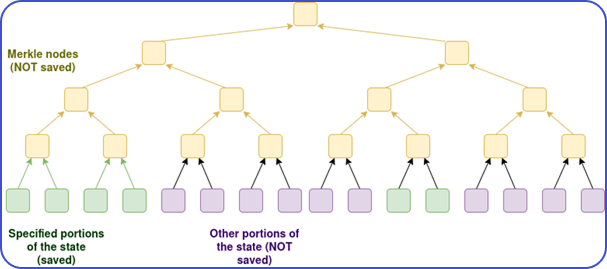

💡Vitalik Buterin Proposes Partially Stateless to Reduce Hardware Burden

Ethereum co-founder Vitalik Buterin proposes an innovative design to minimize the hardware burden of running Ethereum layer-1 nodes.

Buterin proposed the concept of “partially stateless nodes.” It will allow users to store only a subset of the Ethereum data (currently, it is over 1.3 terabytes).

On May 19, Buterin shared in his blog post that the new design will allow ordinary users to execute nodes on their mobile or laptop devices, keeping only the relevant data, without an expensive infrastructure.

Source: Ethereum Research Blog (ethresear.ch)

What are Partially Stateless Nodes?

The Ethereum network is equipped to store over 100 GB of data. However, it could be inconvenient for small-time users who could find it difficult. With stateless nodes, users can choose and keep data that is relevant to them, their wallets, or decentralized platforms. Vitalik claims these nodes can verify new blocks or store necessary data without storing complex Merkle proofs.

Built on the EIP-4444 that limits historical data to reduce storage stress, it will reduce the burden on a single operator, maintain security, and maximize privacy.

💡Good To Know

What are Tokenized Assets?

Tokenized assets are real-world assets converted into blockchain tokens. They can be tangible assets like gold, real estate, or intangible assets like stocks, bonds, or equities. These assets give direct ownership or rights to their owners.

⚠️ Always DYOR: Stay Safe, invest wisely.🛡️

🌐 Market Map

The global crypto market cap on Friday, 23rd May, is $3.59 trillion with🔻3.0% down over the last 24 hours.

🍿 Quick Bytes

Hong Kong passes Stablecoin bill as more governments recognize the digital asset. CNBC.

SafeMoon CEO, Braden Karony, was found guilty of crypto fraud and sentenced to years in prison. Binance.com.

Sui’s Cetus decentralized exchange was hacked worth of $260 million. Crypto Times.

Gemini Credit Card offers crypto rewards for eligible purchases. Yahoo Finance.

🤡 This Week’s Meme Drop 🍕🍕

That’s it for this week, guys!

How did we do? Share your thoughts. 👇

By the way, do you know someone curious about crypto? Why not forward WhaleTales and help them stay ahead with the latest news? 🗞️😇

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice.