Hey, Explorers!

Welcome to the newest edition of WhaleTales, your weekly digest on crypto's hottest stories and shorting insights!

The past week has been a rollercoaster ride for investors. The crypto market mirrored a massive “bloodbath” fueling “Black Monday” speculations as Bitcoin, Ethereum, and other altcoins witnessed significant losses following President Donald Trump’s mega tariff plans.

Amid the chaos, Trump’s 90-day Tariff freeze announcement on April 10 was a glimmer of relief. So, will the crypto market bounce back and ease investor sentiment? Let’s wait and watch. 📈🤞

📬 In Today’s Top News:

President Trump puts a 90-day tariff freeze – China barred!

Hong Kong greenlights crypto staking to licensed exchanges.

Trump becomes the first to sign the crypto bill into law.

EigenLayer unlocks its missing “Slashing” feature.

Thanks for reading WhaleTales! Subscribe to get the latest buzz in the crypto frontier.

The Big Story

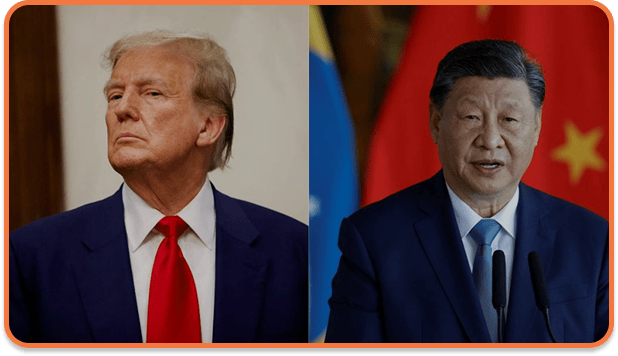

📢Trump puts a 90-day tariff freeze – China barred?! 🥶

Image source: Reuters

In a dramatic reversal, Trump dropped the reciprocal tariffs to a universal 10% baseline rate for 90 days. He added that 75 countries out of 195 worldwide have approached the White House and negotiated instead of going into a trade war that led to the tariff pause.

But was the decision a part of a plan or provoked by panic?

The White House inside story revealed a mounting unrest and fear that Trump’s tariff gamble could lead to a global financial crisis.

There was a lot of pressure from world leaders, business executives, and republicans who warned that the tariff escalation could trigger an economic freefall. The stock market was burning, and the US government bonds (considered the safest) witnessed dramatic sell-offs.

According to a special report, it was the US Treasury Secretary Scott Bessant and other economic advisors who advised President Trump to put a temporary pause on the high tariffs, negotiate with other countries until the market cools off.

In a statement outside the White House, Trump said, “People were getting a little yippy.”

Following the decision, Trump posted on Truth Social:

Source: Truth Social

The decision was likely a tactical response to ease the rising global economic tension, market turbulence, growing public fear, and statements from world leaders, including billionaire Ken Griffin, calling the hefty tariffs a “huge policy mistake.”

Why was China excluded from the tariff pause?

While other countries received the 90-day temporary pause, the tariffs were raised drastically for China.

By Wednesday, the situation escalated and became a cat-and-mouse chase between China and the US. According to President Trump, while most countries refrained from retaliation and were eager to discuss and negotiate, China responded with a drastic 84% tariff hike. He added that China’s “lack of respect” for world trade norms has led to the retaliatory tariff hike of 125%.

“China wants to make a deal. They just don't know how quite to go about it...President Xi Jinping is a proud man. They don't know quite how to go about it, but they'll figure it out.”

President Trump added to Truth Social.

The aftermath:

Immediately following Trump’s tariff pause announcement, the US stock and crypto market witnessed sharp swings with notable price surges. Bitcoin (BTC) soared over 8% and reached $83,541 within 24 hours.

The 90-day tariff pause will run until June and might usher in a surge in the demand for riskier assets like Bitcoin, Ethereum, Solana, etc. Analysts remarked that the crypto market has taken a dramatic rebound post Trump’s tariff pause, and has shifted from deep red to a bullish trajectory. The prices for major altcoins like ETH, SOL, XRP, and ADA have also performed well with significant gains.

Source: Guardian News

In The Spotlight

🟢Hong Kong’s SFC Greenlights Crypto Staking to Licensed Exchanges

Source: Coindesk

Key highlights:

Hong Kong’s SFC gives the official nod to licensed crypto staking platforms.

The announcement contradicts Singapore’s “investor protection” ban in 2023 on staking and lending for retail investors.

On Monday, April 7, Hong Kong’s Securities and Futures Commission (SFC) made a landmark move by releasing new staking guidelines permitting licenses for SFC-authorized Virtual Asset Trading Platforms (VATPs) and Virtual Asset Funds (VA Funds) to offer staking services.

The news came as a breath of fresh air for crypto trading platforms and crypto investors.

But how does it help retail investors?

In the new staking initiative, HODLers (long-term investors) can stake or lock their crypto assets in proof-of-stake blockchain to enhance network operability and, in return, earn staking rewards in a secure and regulated environment.

In the press release, SFC announced that the initiative aims to broaden the potential of the virtual asset ecosystem with improved network security. It will enhance staking and yield-generating opportunities for retail investors in a regulated environment through the “ASPIRe” roadmap.

In its formal statement, SFC announced:

“The potential benefits of staking in enhancing the security of blockchain networks and allowing investors to earn yields on virtual assets within a regulated market environment.”

Julia Leung, SFC’s Chief Executive Director further remarked:

“Broadening the suite of regulated services and products is crucial to sustain the healthy advancement of Hong Kong’s virtual asset ecosystem,” adding that, “the broadening must be done in a regulated environment where the safety of client virtual assets continues to be front and center of the compliance framework for offering such service.”

In the revised circular, SFC laid down the staking guidelines for registered platforms.

TL;DR: The guidelines:

Crypto exchanges must obtain written approval before offering staking services and retain control of staked crypto assets. Delegating custody of assets to a third party is strictly prohibited.

Staking exchanges must disclose vital information to customers like platform fees, minimum lock-up, custodial services, outage plans, unstaking processes, etc. In addition, they are expected to monitor their staking activities, execute risk assessment, and report regularly to the SFC.

With the new guidelines, SFC wants Hong Kong to emerge as a launchpad for crypto and Web3 development in a well-regulated and stable market.

Also Read

⚖️Trump becomes the first President to sign a Crypto bill into law

On Thursday, April 10, President Donald Trump became the first-ever U.S. President to sign a “crypto bill into law” that repeals the Biden-era IRS rule regarding DeFi (decentralized finance) platforms.

The resolution passed by the Senate and the House of Representatives overturns the rules set by the IRS in 2024 (also called the “DeFi Broker Rule”) regarding the enforcement of crypto tax on DeFi exchanges.

A DeFi exchange allows crypto traders to trade, buy, sell, and exchange crypto assets without the intervention of any intermediary, like the government or a bank.

U.S. Representative Mike Carey (R-Ohio-15), who was present during the signing ceremony, said in his statement:

“The DeFi Broker Rule needlessly hindered American innovation, infringed on the privacy of everyday Americans, and was set to overwhelm the IRS with an overflow of new filings that it doesn’t have the infrastructure to handle during tax season. By repealing this misguided rule, President Trump and Congress have given the IRS an opportunity to return its focus to the duties and obligations it already owes to American taxpayers instead of creating a new series of bureaucratic hurdles.”

Earlier, the IRS rule has received widespread criticism from the crypto community and was slammed by the Blockchain Association. Trump’s crypto bill nullifies the IRS rule and reduces the regulatory compliance burden for digital assets.

🔍EigenLayer is ready to roll out its slashing feature – know why it matters

EigenLayer, the Ethereum-based protocol that pioneered “restaking,” will finally unleash the mainnet launch of its much-awaited core feature, “Slashing,” on April 17, to mark its completely integrated version.

EigenLayer made quite a buzz when it was launched in 2024 with over $16 worth of Ether deposits. In October, it rolled out its much-hyped EIGEN token to reward restakers. However, it failed to deploy “Slashing” as its key feature, which remained in the testing phase.

The integration of Slashing will allow Actively Validated Services (AVSs) apps built on the protocol’s restaking platform to set certain preconceived conditions to identify operators for poor performance and misconduct and penalize them. It will reward operators who execute the system successfully.

Source: X

💡Good To Know

What is Crypto Restaking?

Crypto restaking is a process that allows users to stake the same crypto assets or tokens on the parent blockchain and other protocols and secure multiple networks concurrently.

Why restake?

It amplifies network efficiency, operability, and security.

Network operators get greater rewards for restaking the same tokens.

It allows users to earn additional rewards in exchange for taking additional slashing risks.

⚠️ Crypto assets are volatile and carry risks.

🌐 Market Map

The global crypto market cap was 2.78 trillion with🔻0.3% down (over 24 hours). The chart below shows the 24-hour price movement on Sunday 13, 2025.

🍿Quick Bytes

Changpeng Zhao (CZ), former co-founder and CEO of Binance crypto exchange, has joined the Pakistan Crypto Council as its newly appointed Strategic Advisor. – coinmarketcap

Binance announced the delisting of 15 crypto assets and spot trading pairs on April 16. – tradingview

Crypto lawyer James A. Murphy is filing a lawsuit against the U.S. Department of Homeland Security for exposing Satoshi Nakamoto’s identity. – crypto.news

BlackRock CEO Larry Fink promotes “tokenization,” a blockchain-based asset trading that could revolutionize asset ownership and investments. – cnbc

🐳🤡 This Weeks’s Meme Drop

That’s it for this week, guys!

How did we do? Share your thoughts. 👇

Know someone curious about crypto? Why not forward WhaleTales and help them stay ahead with the latest news? 🗞️😇

Join the Whales. See you in the next edition 👋

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice. Crypto investments are risky. We encourage readers to invest wisely.