Deep Dive Into Crypto Biggest News

Welcome back, folks! ☺️

Breaking: Bitcoin does it again. The world’s #1 crypto breaks All-Time High, surpassing $124K with Ethereum holding strong, gearing for its next big move.

Meanwhile, Ethereum, the world’s second-largest digital asset, is in the spotlight. The pioneering blockchain made headlines for a staggering $3.8B pending unstaking queue.

Headlines:

Bitcoin Breaks Record at $124K as Ether Edges Closer

Ethereum Unstaking Queue Hits Record High At $3.8B

Kraken Halts Monero Deposits Amid 51% Attack

The Altcoin Season is Here: Just Hype or Reality?

Crypto Debanking Resurfaces with “Operation Chokepoint 3.0”

Get the latest updates. Subscribe to WhaleTales today.

Deep Dive

🔥 Bitcoin Breaks Record at $124K as Ether Edges Closer

📊 Market news flash: Bitcoin once again breaks record on early Thursday, hitting a new all-time high at $124,496 as Ethereum, the second-largest crypto, trails behind at $4,791.19, highest since 2021. Is $150,000 next for Bitcoin? Experts predict.

In-depth

On August 14, Bitcoin, the flagship crypto, touched $124K, nearing a 30% rise this year. Ethereum surged overnight, inching closer to its $4866 record of 2021.

What pushed Bitcoin? 🤔

Institutional adoption has significantly contributed to Bitcoin’s rally. Institutional buying and corporate adoption fueled Bitcoin’s price drive this year. As of August 13 reports, nearly 1.5 million bitcoins flowed into ETFs.

The U.S. Treasury Secretary Scott Bessent added to the initial hype by saying that the Federal Reserve will explore “budget-neutral” ways to expand the Bitcoin reserve. Bessent commented that Bitcoin has finally been forfeited to the federal government and will be included in Trump’s March U.S. strategic Bitcoin reserve executive order. Although later on Thursday, Bessent dampened all hopes, stating outright that the U.S. government will not buy additional Bitcoin to support its crypto reserve.

👉 Read More Here: US Will Not Be Purchasing Any Bitcoin, Treasury Secretary Bessent Says.

The July Consumer Price Index (CPI) rose by 2.7% year/year, lower than expected, which boosted public optimism.

Crypto President Donald Trump’s 401(K) plans for American retirees and crypto-friendly regulations further bolstered the market sentiment for Bitcoin.

Could Bitcoin hit $150K? 🤯

Canary Capita CEO, Steven McClurg, predicted that Bitcoin could hit $150K before the end of 2025.

“There’s a greater than 50% chance that Bitcoin goes to the $140,000 to $150,000 range this year before we see another bear market next year,” said McClurg in a CNBC interview on Friday.

According to Benzinga reports, a new poll by respondents suggested slim chances of Bitcoin hitting $150K before returning to $100K or below. With just 4 months to 2026, it is uncertain whether Bitcoin could reach the ambitious $150K, but the current bullish pattern, macroeconomic shifts, and positive investor sentiments seem favourable for Bitcoin.

👉 Related: Fundstrat’s Tom Lee Suggests Bitcoin Will Catch Up to Gold Now that Deleveraging Is Over.

🤝 In Partnership With The Pacaso / Pacaso

Former Zillow exec targets $1.3T

The top companies target big markets. Like Nvidia growing ~200% in 2024 on AI’s $214B tailwind. That’s why the same VCs behind Uber and Venmo also backed Pacaso. Created by a former Zillow exec, Pacaso’s co-ownership tech transforms a $1.3 trillion market. With $110M+ in gross profit to date, Pacaso just reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Exclusive

⏳Ethereum Unstaking Queue Hits Record High At $3.8B

The Ethereum validator Queue for unstaking reaches a record-breaking exit queue of over 861,758 ETH worth $3.8 billion.

Details:

Ethereum unstaking reached new heights. Ethereum holders have queued up to unstake tokens worth $3.8 billion on late Friday, which could put paramount selling pressure.

Ethereum staking is a mechanism where people “stake” or commit their assets to secure the blockchain that runs on the “proof-of-stake” consensus mechanism. Staking validates transactions and improves the Ethereum network’s efficiency. In return, the validators (people who stake) earn staking rewards. Now these validators, also known as stakers, can choose to unlock or “unstake” and withdraw their rewards and staked assets. But there is a waiting period called the “unstaking” period.

Now, Ethereum has a limit on the amount of ETH that can be unstaked or withdrawn at a given time. Currently, the unstaking period for withdrawal is 15 days.

The mounting unstaking queue may reflect a surge in sell-offs and profit-making activity for users. But despite the increasing selling pressure, Ignas DeFi research suggests that large ETH treasuries and spot ETH ETFs (Exchange-traded Funds) could absorb the pressure and balance it out.

Furthermore, analysts believe the unstaking surge may not be a bearish trend but highlights a strategic move for ETH investors trying to re-enter the market by liquidating their assets.

🎯 Together With INBO

A Dedicated Home for Your Favorite Newsletters

Your favorite newsletters arrive mixed with work emails, promotions, and notifications. By the time you have a moment to read, they're buried 50 emails deep.

INBO solves this with intentional design.

A calm, dedicated inbox where newsletters wait patiently for your attention, not competing with urgent messages or promotional noise.

Your reading time deserves better than email chaos.

📌 At A Glance

Kraken Halts Monero Deposits Amid 51% Attack 🐙

Crypto exchange Kraken has temporarily paused Monero (XMR) deposits on its platform following a 51% attack that jolted its blockchain. On Tuesday, Aug 12, Sergey Ivancheglo, the co-founder of Qubic, an AI-focused, layer-1 blockchain network, claimed that their mining pool has seized a major control of Kraken’s hashrate by using useful proof-of-work (uPoW or UPoW) consensus mechanism. 📎Read More at CoinTelegraph.

The Altcoin Season is Here: Just Hype or Reality? 🔥

The altcoin season or “altseason,” typically reflects the downturn of Bitcoin dominance, where investors gradually shift towards Ethereum and other altcoins. Recent market data shows that various altcoins have outperformed Bitcoin, signalling an impending altseason. However, the Coinglass Altcoin Season Index suggests a metric of 51, a balanced neutral zone for altcoins, but still a strong Bitcoin dominance. 📎Read More at Mitrade.

Crypto Debanking Resurfaces with “Operation Chokepoint 3.0” 🔒

Debanking resurfaces as JPMorgan allegedly implements banking restrictions and exorbitant fees, dubbed “Operation Chokepoint 3.0,” tightening access to crypto firms and the fintech community. These restrictions will undermine basic services for crypto firms, like fund transfer to alternative platforms. Fear prevails that if JPMorgan successfully executes Chokepoint 3.0, other banks will soon follow. 📎Read More at CryptoWeekly.

💡Good To Know

What is the Crypto Fear and Greed Index?

A Crypto Fear and Greed Index ranges from 0 to 100, which describes the crypto market sentiment. Here, “0” indicates “extreme fear,” and “100” indicates “extreme greed.” This index helps to understand market trends, whether investors are optimistic or pessimistic, and the entry and exit timings to the market.

😎 Calculate Fear and Greed Metrics at CoinMarketCap.

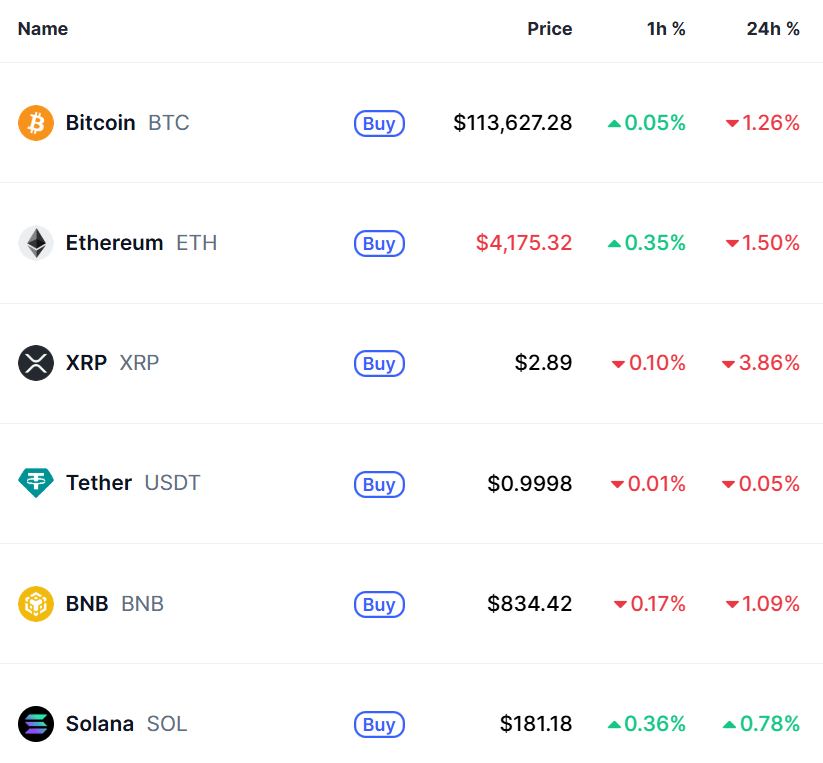

🌐 Market Map

Cryptocurrency prices on 20th August according to CoinMarketCap.

🍿 Quick Bytes

Standard Charted has seized the stablecoin opportunity in Hong Kong (China SAR). Yahoo Finance

Thailand to launch crypto-to-baht conversion for foreign tourists. Reuters

Strategy Acquires 430 Bitcoin, Bolstering Holdings to 629,376 BTC. Bitcoin.com

Brazil’s Crypto Sector Sounds Alarm Over Surprise Tax Proposal. Forbes

🤡 This Week’s Meme Drop

That’s it for this week guys. Before you go, do not forget to sign up with WhaleTales newsletter. See ya all next week. 🗞️😇

How did we do? Share your thoughts. 👇

Disclaimer: The information provided in this newsletter is educational and not intended for any investment or financial advice.